How to set up your BIMB account

Everything you need to get started with your online banking

Four Essential Steps

To start making online transactions, you’ll need to complete these four essential steps

Install the BIMB Mobile app from the app store and log in with your details.

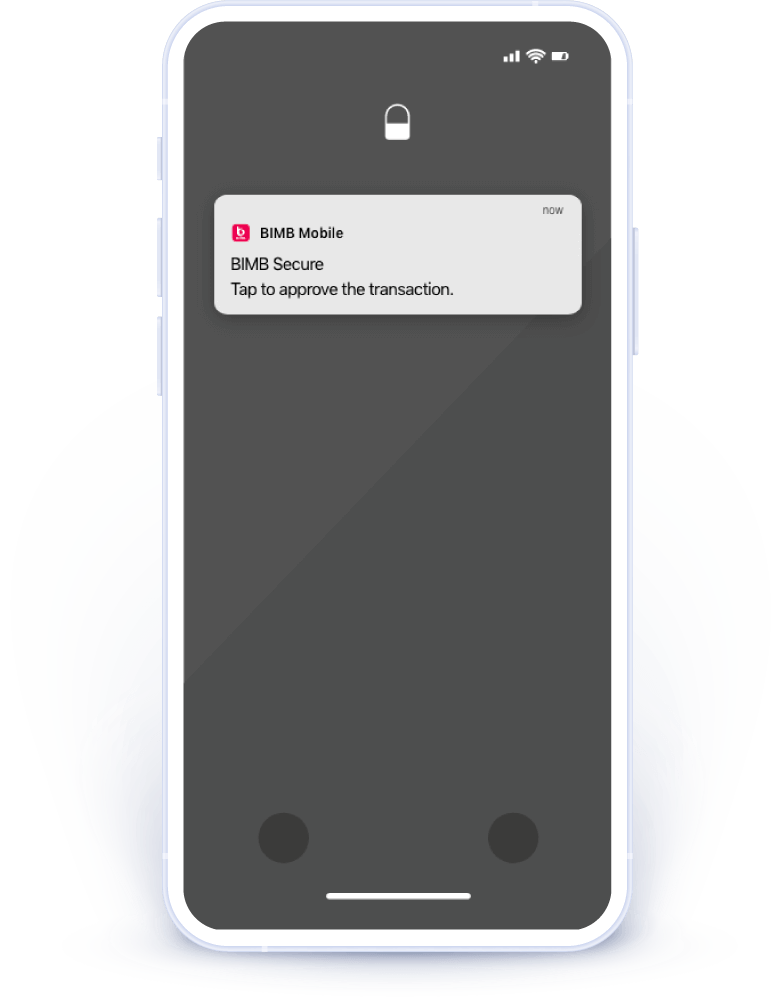

Login to BIMB Mobile to activate BIMB Secure.

BIMB Secure is an authentication method to authorise transactions initiated from BIMB Web and BIMB Mobile.

Activate your account at the nearest Bank Islam ATM or branch to enable your online banking.

What you need to know?

- Not applicable if you switch to BIMB Mobile from GO by Bank Islam app from the same device.

- Only applicable to new users and

BIMB users or those who have changed their device. - For overseas customers, please reach out to our Contact Centre +603-26 900 900 or email at contactcenter@bankislam.com.my

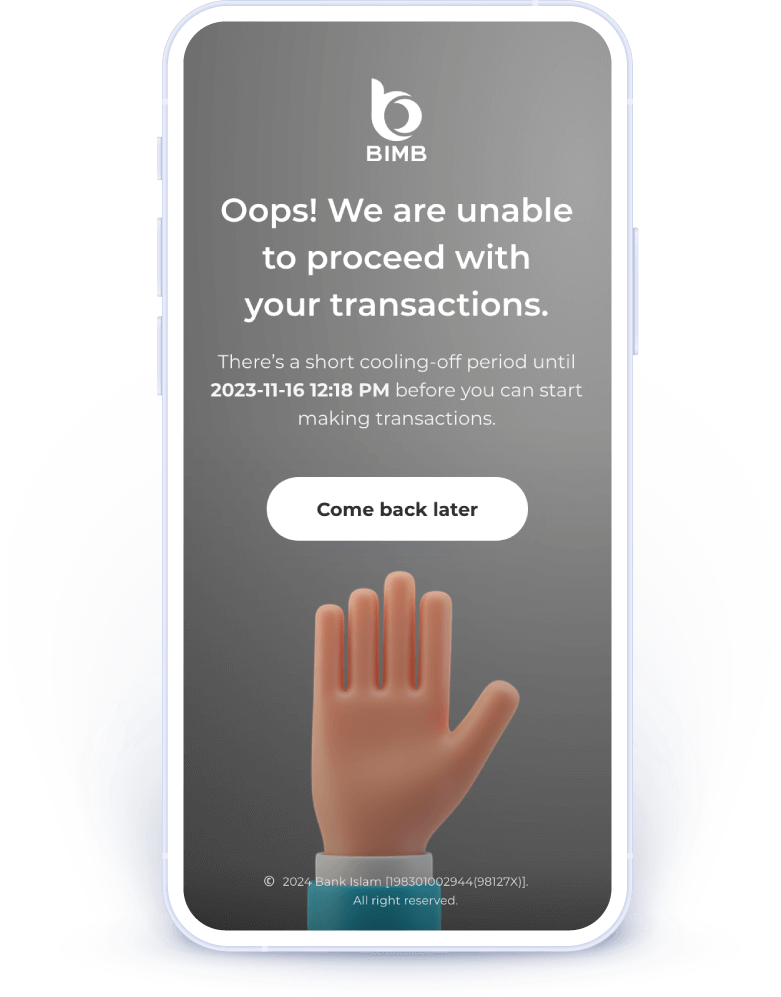

After verifying your identity, a brief cooling-off period is in place before you can make online monetary transactions.

This measure allows you to review your account access and take action if you notice any suspicious activity, such as blocking the account or reporting it to the authorities. This way, your account remains secure and under your control.

Frequently asked questions

BIMB Account setup

After downloading BIMB Mobile, register using your existing BIMB Web Username, password, and your Identification Card (IC) / Identification Document (ID) number to bind your device with your Internet Banking Username.

For existing BIMB Web users: -

- Enter your Username and password.

- Enter your MyKad/ID number.

If you do not have a Username, first register for BIMB Web here https://web.bimb.com/. For subsequent logins, you can use your fingerprint (if supported by your mobile device) or your existing BIMB Web password.

Note: After completing the first-time setup as a new user for BIMB Mobile, you must activate your access before performing any banking transactions. Activation can be done at Bank Islam's Automated Teller Machines (ATM), branches or via the Contact Centre (for customers overseas or without access to branches and ATM).

After completing the initial setup, activate the service by following these steps:

- Activation via ATM/ CRM

- Visit any Bank Islam ATM/ CRM

- Insert your debit or credit card

- Enter your 6-digit PIN to access the Main Menu

- Select ‘Others’

- Select ’Online Access Activation’

- Complete the activation process

- Activation at Branch

- Visit any Bank Islam branch

- Fill out and submit the Activation Request Form

- The branch will process your activation request

Note: For overseas customers, please email to Bank Islam Contact Center at contactcenter@bankislam.com.my or for instant support, connect with Chatbot Adam at www.bimb.com.

Yes, you can register for the BIMB Mobile even if you don't have a Bank Islam savings account. Complete the online activation at an ATM or by visiting the nearest branch.

Note: For overseas customers, please email to Bank Islam Contact Centre at contactcenter@bankislam.com.my or for instant support, connect with Chatbot Adam at www.bimb.com. to perform online activation.

To sign up for BIMB Web, you must:

- 18 years or older.

- Have an Individual Current/Savings/ Transactional Investment Account or a Sole Proprietor Account; or have a financing facility.

- Have Bank Islam ATM/Debit Card-i or Credit Card-i.

- Have ATM PIN.

Online activation access

Activation is required for:

- New users who have recently registered for BIMB Web.

- Existing customers of BIMB Web who are new users of the BIMB Mobile app.

- Existing customers of BIMB Web who have installed the BIMB Mobile app on a new mobile device.

Note: Existing users who are already using these services are not required to perform activation.

You need to complete the required steps for the first-time set up for BIMB Web or BIMB Mobile before you can activate your online access.

You can activate your online access through any of these three options:

- Go to any Bank Islam ATM/CRM:

-

- Insert your debit or credit card into the ATM/CRM

- Enter your 6-digit PIN to access the Main Menu

- Select ‘Others’

- Select ’Online Access Activation’

- Complete the activation process

- Bank Islam Branch:

-

- Fill out and submit the Activation Request Form

- The branch will process your activation request

- Email Contact Centre:

This option is available specifically for overseas customers. Please email to Bank Islam Contact Centre at contactcenter@bankislam.com.my or for instant support, connect with Chatbot Adam at www.bankislam.com

Note: The cooling-off period starts immediately after the activation process has been successfully completed.

Cooling off

BIMB Secure

To authorise a transaction using BIMB Secure, follow these steps:

- Launch the BIMB Mobile app

- Select Quick Menu

- Select ‘BIMB Secure’

- Verify the transaction details

- Once verified, select ‘Authorise’

- The authorisation process is now complete